News and publications

Discover our latest news, event participations, publications and recruitement offers

30/10/2020

Cloud-Native viewed by investor (Part 1)

Understanding one of the current hottest markets

Read the report

17/06/2020

4th edition of French Corporate VC barometer

Download your copy

Read more

21/04/2020

InsideBoard

We welcome InsideBoard into our portfolio

Learn more

21/04/2020

Corporate Venture post Covid-19

How has Covid-19 changed the mood of corporate venture capital?

Learn more

10/03/2020

Youverify joins our portfolio

Orange Ventures leads $1.5m investment round in Youverify

Read more

10/02/2020

Gebeya joins our portfolio

OV co-leads pre series A of the Pan African Ed Tech & online Marketplace

Learn more

12/04/2019

We are #MovingForward

Orange Ventures code of Conduct

Read more

21/10/2019

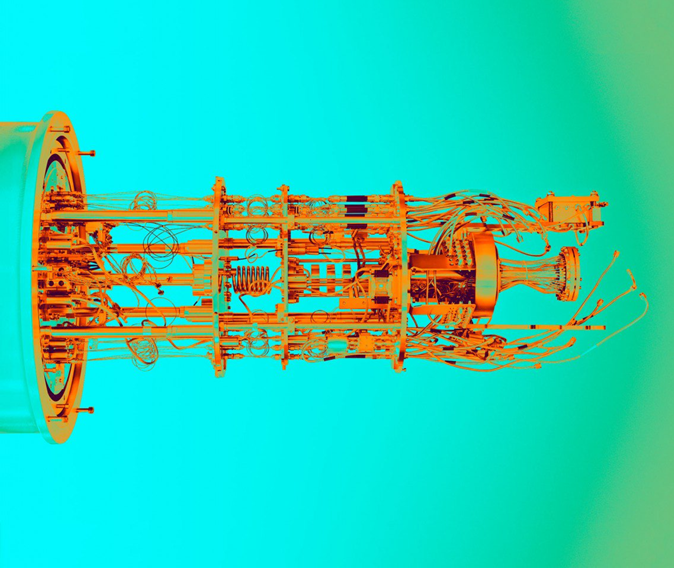

Quantum computing for dummies

In the words of our analyst

Learn more

01/07/2019

Africa’s tech growth

Our take on today’s ecosystem & key driving forces behind it

Learn more